Multichoice Nigeria Limited, a company offering satellite television services across Africa, fell victim to a fraudulent foreign currency exchange transaction, resulting in a loss of N7.9 billion.

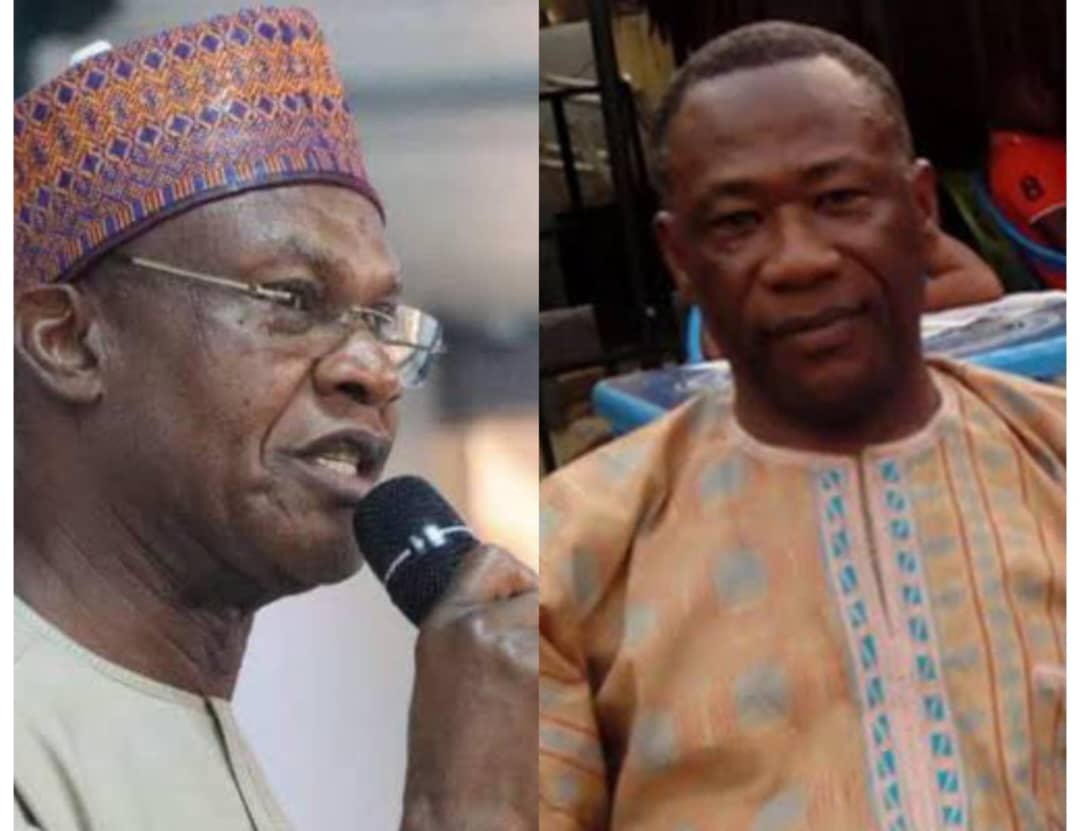

The failed foreign currency exchange deal implicated Akintunde Giwa, who works as a currency exchange broker; JNFX Limited, a company specializing in currency exchange services; Ashay Mervyn, a representative of JNFX; and Frontier Financial Technologies Limited.

Mr. Giwa is a currency exchange broker who helps individuals exchange Nigerian Naira for US dollars, earning a commission for his services. According to court documents, Mr. Mervyn is a director at Frontier Financial Technologies Limited, a Nigerian company.

The matter came before Stuart Isaacs, serving in the capacity of Deputy Judge at the High Court in the Business and Property Courts of England and Wales. The ruling was transmitted digitally to the legal representatives of the parties and subsequently filed at the National Archives on 2 April.

According to court records, Multichoice Nigeria Limited transferred N7.9 billion to Mr. Giwa, a currency exchange broker. Mr. Giwa then passed the funds to JNFX Limited, a currency exchange firm, as part of the MultiChoice contracts. The records reveal that the Naira payments were first deposited into accounts held by Mr. Giwa’s companies, before being transferred to accounts specified by JNFX via Mr. Mervyn in exchange for dollars. These dollars were then supposed to be deposited into an account at Standard Chartered Bank in London under the name of MultiChoice Africa, a separate entity within the MultiChoice group of companies.

Nevertheless, the company did not receive any payments in dollars, totaling $16.2 million, as disclosed by Mr. Giwa.