The Presidential Committee on Fiscal Policy and Tax Reforms is suggesting an adjustment in the distribution of Value Added Tax revenue, recommending that states and local governments receive 90 per cent, while the Federal Government’s share be reduced from 15 to 10 percent.

The committee also suggested increasing the existing 7.5 percent fees that are currently being applied to customers.

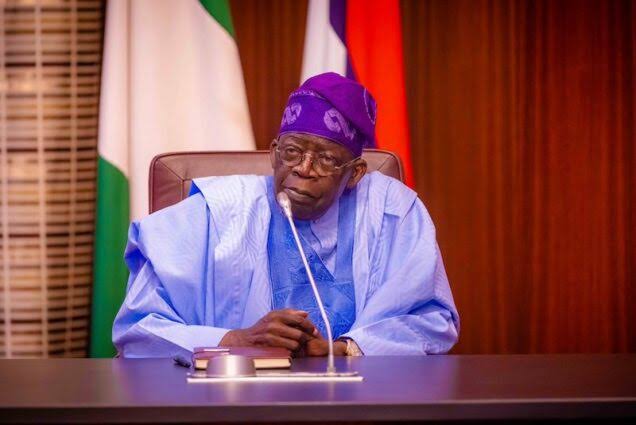

During a stakeholder meeting held in Abuja to deliberate on key highlights of the National Tax Policy, Taiwo Oyedele, the committee Chairman, shared this information.

He said, “We are proposing that the Federal Government’s portion should be reduced from 15 per cent to 10 per cent. States’ portion will be increased but they would share 90 per cent with local governments,”

“The burden of Value Added Tax should be with the ultimate consumer. So we must make it transparent and neutral and this is what over 100 countries where they have VAT are doing. Nigeria’s economy is more than 50 per cent in services and if I just stop at this, many states will be broke because VAT collection will go down by more than 50 per cent and it won’t even fly.

“So we therefore need to adjust the VAT rate upward. We would ensure that it doesn’t affect businesses. The only thing is to look at basic consumption from food, education, medical services and accommodation will carry zero per cent VAT. So for the poor and small businesses, no VAT.

“Then for the rest of us, we will pay a little bit more. We have spoken to businesses about it and they won’t increase the product price. We want to make sure when we do VAT reform, no one will increase the price of commodities. We will work the Mathematic with the private sector.”

“We are thinking that we should adjust the sharing formula for VAT because it is a tax of the states. In 1986, we had sales tax collected by states. The military came up with VAT in 1993 and stopped sales tax so they said it would collect VAT and return 15 per cent as cost of collection and that is the 15 per cent charged today came about. But we think it is too much”.